Understanding Paladin: An Analysis for Solana Validators And Stakers

In my last article on MEV in 2024, I discussed how Solana's explosive growth brought both opportunities and challenges, particularly highlighting how transaction orderflow naturally tends toward consolidation. While I outlined optimistic paths forward where innovation and collaboration could expand the ecosystem's total value, we continue to see participants fighting over pieces of a fixed pie through increasingly complex arrangements and proprietary solutions. Rather than pursuing technical innovations that could benefit all participants, the ecosystem has trended toward fragmentation through private swQOS deals, backdoor deals, and opaque reward distributions - creating artificial barriers and privileged lanes that concentrate value among a select few participants while making the system more complex for everyone else.

Today, I want to examine Paladin, a development that serves as a good illustration of these concerning trends. While its core features may seem straightforward – a priority port for transactions and filtering for sandwich attacks – a deeper analysis reveals it reduces validator and staker revenue in addition to breaking functionality relied on by applications and wallets on Solana. Beyond these concerns, the introduction of yet another token-based incentive system raises questions about whether validators are being offered genuine innovation or simply a repackaging of existing infrastructure behind new token requirements.

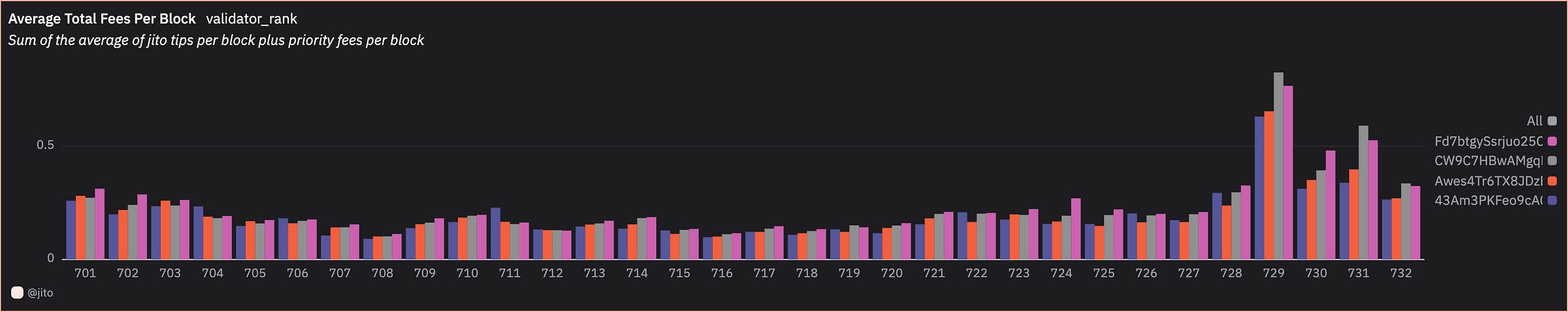

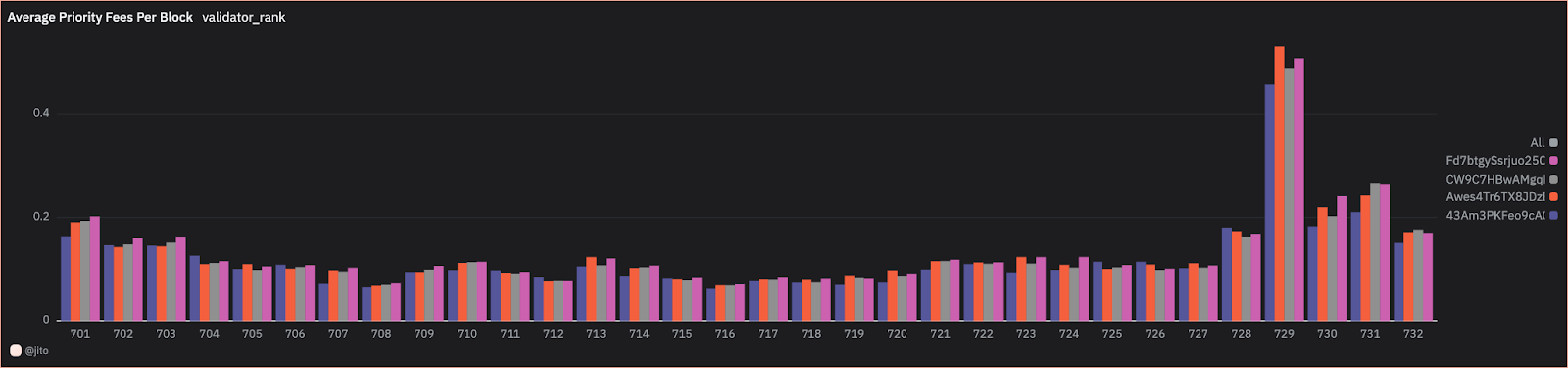

Despite frequent social media posts celebrating increased block rewards, transparency around validator and staker rewards remains limited. While the Paladin team has promised to release public dashboards to verify their performance claims, the community is still waiting for access to this data. To help inform validator decision-making with concrete data, I decided to build a quick dashboard analyzing several validators running Paladin, and found the following:

While priority fees show no significant difference between Paladin and Jito-Solana validators, blocks produced by those running Paladin earn between 25-50% less in combined fees and Jito tips

After SIMD-0096's upcoming activation, which doesn't burn 50% of priority fees, Paladin blocks still earn significantly less

Paladin stakers earn about 20-50% lower MEV rewards from tips compared to staking with Jito-Solana validators

Most validators share the majority of Jito tips with their stakers but few share priority fees currently. Even if total fees were flat, a transfer of value from Jito tips to priority fees results in lower rewards for network stakers.

Jito-Solana validators are including approximately 100 more transactions per block, resulting in ~250 transactions per second increase in network throughput

As validators and stakers consider adoption of Paladin, understanding hidden dynamics becomes increasingly critical. Rather than introducing fundamental improvements that could benefit the entire network, Paladin appears primarily focused on capturing and redirecting existing transaction flows through its token-gated architecture. This approach threatens to deepen existing divisions in how transactions reach validators, creating new barriers that make the ecosystem more complex and less efficient.

Looking ahead, the Solana ecosystem has an opportunity to develop MEV infrastructure that truly grows the pie for all participants – but first, we need to carefully examine whether token-gated access to existing functionality serves or hinders this goal.

What is Paladin?

Examining Paladin's codebase reveals an important starting point for validators considering adoption - it represents a direct fork of Jito-Solana, the first iteration of Solana MEV infrastructure that introduced bundle auctions and transparent reward distribution to Solana validators and stakers, generating $925M for validators and stakers. Rather than building substantially new infrastructure, Paladin's main additions consist of a priority transaction port, a slightly modified transaction execution stage, and sandwich detection system. Validators must carefully consider whether further fragmenting transaction flows through a new token-gated system provides meaningful value, especially when building on existing open infrastructure that already handles these core functions. The introduction of token requirements and privileged access on top of established functionality seems to prioritize value capture over technical innovation.

P3

The P3 priority port exemplifies key architectural choices in building network infrastructure. Currently implemented as a UDP packet endpoint, it operates through a whitelist system for Bloxroute's use. According to Paladin's roadmap, this will transition to a QUIC server where transaction prioritization depends on PAL token holdings rather than traditional stake weight, directly importing Agave's server code but replacing its established SOL stake weighting mechanism with PAL stake weighting.

This design reflects a concerning pattern in transaction orderflow - creating privileged lanes without meaningfully improving network capabilities. The initial whitelist system will simply transform into another form of restricted access through token ownership, with a significant PAL allocation to Bloxroute's founder further concentrating these privileges. While early adopters may temporarily benefit from low port congestion, this advantage naturally diminishes as access expands, highlighting how artificial scarcity fails to create lasting value for the ecosystem.

Sustainable network improvements should instead focus on creating value through increased capacity or better prioritization of high-value transactions, not through artificial scarcity through token-gated access points. Without technical innovations that expand the network's capabilities, fragmenting access becomes a zero or negative-sum game that ultimately reduces network efficiency. If multiple parties create their own restricted transaction lanes by forking existing clients, they fragment the transaction flow that validators and applications rely on, making the entire system more complex and less efficient. This pattern of forking clients to capture value rather than innovating creates a race to the bottom - each new fork further splits the ecosystem's transaction flow, increases operational complexity for validators, and forces applications to handle an ever-growing set of edge cases. The end result is a more fragmented, less efficient network where participants compete over existing value rather than collaborating to expand the network's fundamental capabilities.

Sandwich Detection

The sandwich detection system may significantly reduce validator revenue while breaking core functionality that users, applications, and wallets rely on. Through an overly aggressive and simplistic transaction filtering approach, the client implements basic pattern matching that indiscriminately censors legitimate and beneficial trades like arbitrage and backrunning that helps maintain price consistency across the ecosystem. This means validators running Paladin could miss out on substantial revenue from legitimate trading activity while actually making the network less efficient.

Beyond these immediate revenue impacts, Paladin's modifications disrupt bundle processing rules that were built to maximize blockspace expressiveness and efficiency. The current bundle system enables sophisticated transaction ordering that many wallets, DeFi applications, and upcoming products depend on for core functionality. Ironically, these changes even break Bloxroute's own product Backrunme - the founder's backrun service fails to work correctly with their own validator client modifications. This illustrates how arbitrary modifications can have unintended consequences across the ecosystem.

By changing these processing rules, Paladin breaks integrations that rely on well-documented bundle behaviors, forcing developers to handle undefined edge cases and users to deal with unexpectedly failed transactions. This incompatibility represents yet another form of ecosystem fragmentation - instead of maintaining consistent behavior that applications can rely on, Paladin introduces unnecessary complexity by diverging from established standards without providing meaningful improvements. Having core functionality randomly broken by a third party creates friction that makes the ecosystem more complex for everyone, raising the question of whether fragmenting basic transaction processing is worth any potential benefits their modifications might offer.

Even if these immediate issues were resolved, history suggests pattern-based sandwich prevention is unlikely to remain effective. As detailed in my last article, when we implemented transaction pattern detection similar to Paladin, sandwich traders developed workarounds in less than three days. As financial incentives grow, they develop increasingly sophisticated approaches - splitting transactions across multiple bundles, implementing probabilistic strategies, significantly modifying validator clients, and finding creative ways to obscure their patterns. While the team has suggested it prevents sandwiching, the current low rate of sandwich attacks likely reflects Paladin's limited stake rather than the effectiveness of its detection system.

PAL Token

The introduction of the PAL token exemplifies a critical juncture in how we think about value creation in blockchain infrastructure. Recent social media activity from the Paladin team has focused heavily on token price movement and an airdrop rather than discussing concrete technical improvements their infrastructure might bring to the Solana ecosystem. This emphasis becomes particularly notable when examining the token's proposed utility. The primary feature, priority access to transaction submission through the P3 port, effectively tokenizes existing network capabilities rather than creating new ones. The significant token allocation to Bloxroute's founder further concentrates control over these access points.

Exploring Data

An analysis of validator performance was conducted using a custom-built dashboard, comparing key metrics between Jito-Solana and Paladin validators. The study focused on four major validators, with Figment (Fd7) and Coinbase 02 (CW9) representing Jito-Solana, and Titan Analytics (43A) and Staking Facilities (Awes) representing Paladin.

Priority Fees Per Block

When examining priority fees per block, the data reveals no significant difference between Paladin and Jito-Solana validators. The validator rankings for priority fees show comparable performance across both systems, suggesting that Paladin's priority port does not provide the advantage in fee collection that has been advertised.

Transactions Per Second

A striking divergence in transaction processing efficiency emerged around epochs 712/713. Jito-Solana validators demonstrate superior performance, processing approximately 23% more transactions per block than their Paladin counterparts. This difference translates to roughly 250 additional transactions per second, representing a substantial advantage in network throughput. The validator ranking charts confirm this performance gap has remained consistent over time.

Tips Per Block

The distribution of Jito tips reveals another important distinction between the two systems. Jito-Solana validators consistently earn higher tips per block, which directly translates to better returns for stakers and validators through increased staking yield and rewards. Stakers staking to a Jito-Solana validator will have significantly higher rewards than those staking to Paladin validators. The ranking charts demonstrate this is not a temporary fluctuation but rather a persistent trend in performance.

Data Summary

This analysis raises questions for some of Paladin's core value propositions and previously made public statements, particularly regarding validator revenue optimization and network efficiency. The data suggests that despite Paladin's claims, their system may actually be underperforming in key areas that directly impact validator and staker returns. These findings contribute important data points to the ongoing discussion about validator infrastructure in the Solana ecosystem. Given that validator and staker returns directly impact network security, the community would benefit from increased transparency and open dialogue about performance metrics across different solutions. As the ecosystem continues to evolve, validators and stakers might consider asking for more detailed performance data to help inform their decisions about which infrastructure best serves their needs and the network's long-term health.

Final Thoughts

While Paladin presents itself as a solution to increase revenue, the lack of public data previously made it impossible for the community to verify its claims. The analysis I've conducted using a public dashboard reveals important insights: Paladin validators process significantly fewer transactions per block and earn significantly less in combined fees and tips compared to Jito-Solana. These metrics raise questions about the value proposition for validators and stakers, particularly given the contrast with public statements about expected performance benefits.

More fundamentally, this data raises questions about whether introducing another token-gated transaction processing system meaningfully improves the Solana ecosystem. Rather than developing technical innovations that expand network capabilities, Paladin's approach appears focused on fragmenting existing transaction flows through artificial access restrictions. This fragmentation introduces additional complexity without clear benefits. Beyond the reduced transaction throughput and lower rewards shown in the data, the modifications disrupt established bundle processing rules that many wallets and DeFi applications rely on for core functionality. By altering these fundamental behaviors around blockspace expressiveness, Paladin creates unexpected edge cases that applications must now handle, making the ecosystem more complex for all participants.

As validators evaluate their path forward, they should consider whether adopting infrastructure that fragments transaction flows and restricts access through token ownership truly serves their long-term interests and those of the network they secure. The health of the Solana ecosystem depends on building open, efficient infrastructure that creates new value - not redistributing existing value flows through increasingly complex arrangements.

In upcoming articles, I plan to explore more constructive paths forward - examining how collaboration and unifying flow could expand the ecosystem's total value rather than redistributing existing flows. By focusing on fundamental improvements that benefit all participants, we can work toward infrastructure that truly grows the pie rather than creating artificial barriers to access.